Auto-matching for QuickBooks Payments

BY WILLIAM “BILL” MURPHY

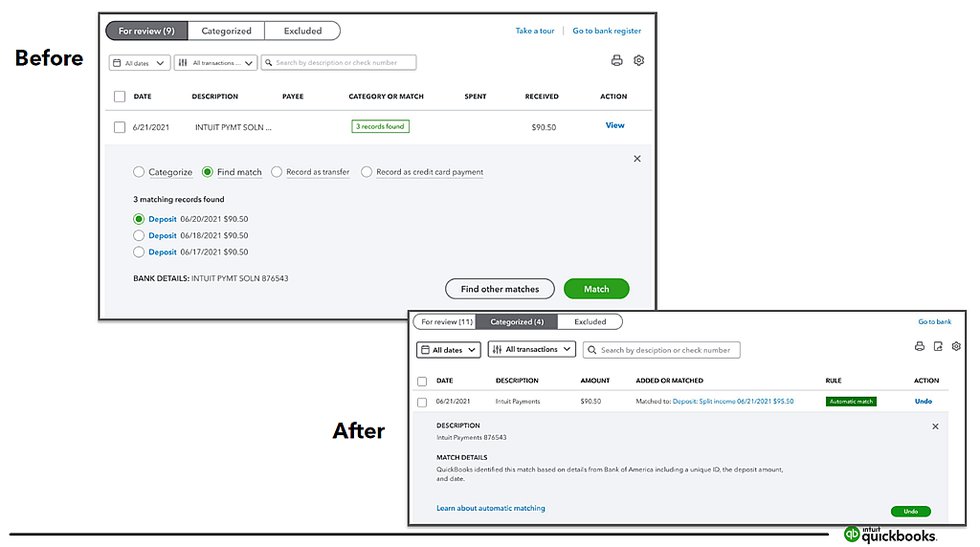

Bank feed matching can be time-consuming, even for payments processed using QuickBooks. This is especially true when there are multiple transactions for the same amount on the same day. It is many times tedious work to make certain you get the payments matched correctly.

But now, starting in mid-July, Intuit QuickBooks is introducing Auto-match for QuickBooks Payments. This feature will provide an automatic high-confidence match for payments processed by QuickBooks based upon a unique ID, the amount and date.

It means you will no longer have to spend time matching payments—QuickBooks will match them for you.

Illustration furnished by Intuit QuickBooks

- QuickBooks will make a match when it recognizes a QuickBooks Payment and a corresponding deposit based on three determining factors: unique ID, the deposit amount and date.

- If the transaction was processed through QuickBooks Payments, QuickBooks will know which payment matches with a corresponding deposit—even if two transactions are for the same amount. This is because QuickBooks is using all three of the determining factors described above.

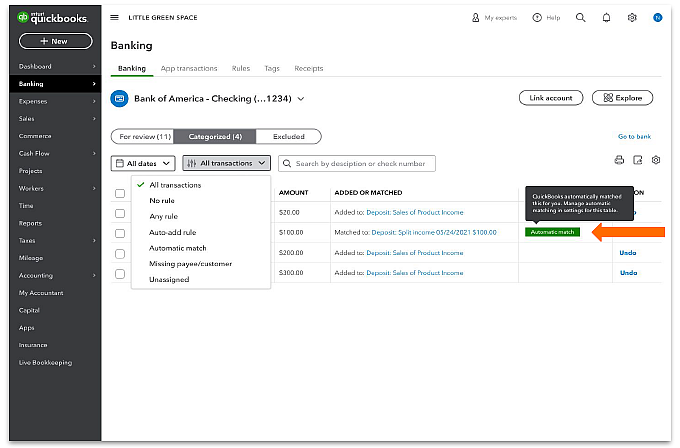

- QuickBooks automatically matches transactions only when confident it is right, but that does not mean you cannot undo a transaction that QuickBooks has already matched. You will easily identify when a transaction has been automatically matched when Automatic-match appears under the Rule Column in your categorized transactions.

Adapted from Intuit QuickBooks provided Source Image

Acknowledgements and Disclosures:

Portions of this feature, including graphical artwork contained herein, have been adapted from Intuit source content. All such materials within this feature were adapted from Intuit sources by Insightful Accountant solely for educational purposes.

As used herein, QuickBooks, QuickBooks Online and QuickBooks Payments refer to one or more registered trademarks of Intuit Inc., a publicly traded corporation headquartered in Mountain View, California.

Any other trade names used herein, including those of the sponsors (vendors) featured within this article, refer to products that may be registered, trademarked, or otherwise held by their respective owners; they are referenced for informational and educational purposes only.

This is an editorial feature, not sponsored content. No company or other person mentioned within this article has paid Insightful Accountant or the author any form of remuneration to be the subject of this feature. The article is provided solely for informational and educational purposes.

Publication of this article should not be interpreted as any form of endorsement by either the author or Insightful Accountant.